There’s been a recent slew of good news for those of us in the mobile space in terms of earning revenue. In case your company is debating whether going mobile-first is a financially sound business strategy, here are 4 take-aways to consider from these recent reports.

1. Consumer spending on mobile is up.

Probably no surprise to anyone anymore, but mobile spend continues to grow year-over-year. According to Business Insider, iPhone users spent on average $40 each in 2016. This is a 14% increase from 2015 despite a small decline in overall app installs. As always, much of the spend came from games but there were growth in other categories, especially as Apple pushes to become a more services-oriented company (ie. Apple Music).

But what of Android which has always lagged far behind Apple in terms of app profitability? There seems to be good news there too. According to a Q4 survey from PubMatic, Android ad revenue exceeded iOS ad revenue for the first time. While this is an indirect statistic to app revenue, it does show that Android apps provide as much benefit to ad dollars as with Apple, which will keep both platforms attractive to developers and companies looking to monetize mobile users.

In total, according to comScore, mobile spending during the holiday quarter amounted to $22.7 billion of the total spent online ($109.3 billion). This was an increase of 45% from Q4 of 2015. It’s a growing slice of the pie and if your company isn’t earning sales off mobile apps, you’re definitely missing out.

2. Mobile continues to influence off-line spend.

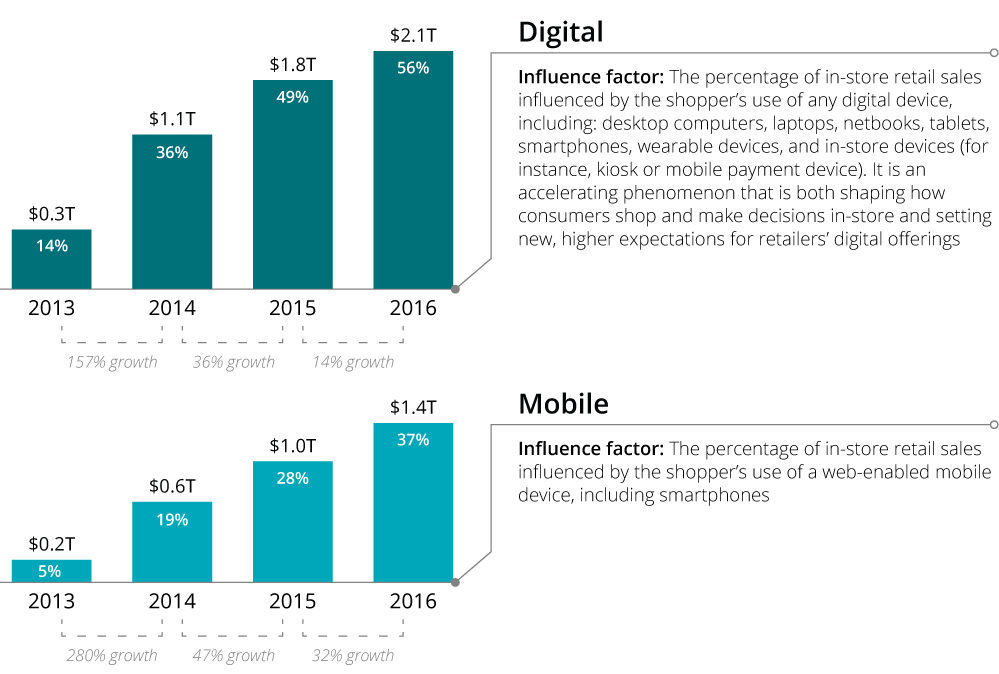

While mobile retail sales are growing, they remain just a tiny percentage of total retail sales to the tune of 1.3% according to Forrester. However, it’s clear that mobile traffic directly impacts off-line sales. Deloitte says 56% of off-line sales are influenced by digital traffic and a giant chunk of that is due to mobile traffic. To put in terms of dollars, Deloitte estimates that of the $2.1 trillion retail sales influenced by digital, $1.4 trillion of that was driven by mobile.

We’ve written about how to use your company’s app to increase your retail sales and it seems like more and more companies are realizing just how powerful a marketing tool apps are. Since 84% of shoppers with smartphones use their devices while in stores, it’s no wonder that there is this “mobile bump.” It’s fair to assume that mobile’s influence here will continue to grow, but taper off as devices saturate the market. Which means companies should take advantage of this quickly.

3. Mobile wallet spend is up.

More users are getting comfortable ditching both cash and card, and tapping their phone instead. According to Juniper Research, mobile wallet spend globally “is expected to rise by nearly 32% this year to $1.35 trillion.” To be fair, much of this spend is centered in eastern countries like China where mobile wallets have been embraced more so than in the US and Europe, but western countries are expected to make great strides due to increased user comfort, easier to use apps, and deregulation. In fact, Forrester estimates US mobile payment transactions will grow to over $280 billion by 2021.

It’s good to see that app developers’ investment in security and privacy is paying off in consumer confidence. In one survey by Mobile Payments Today (ok, sure, that name might imply a bias), 80% of consumers felt mobile wallets are secure. Even if this number is exaggerated, it shows that half of all mobile shoppers are willing to put their financial trust in apps. As long as companies can maintain this trust, we should see these transactions continue to grow rapidly.

4. In-app transactions are on the rise.

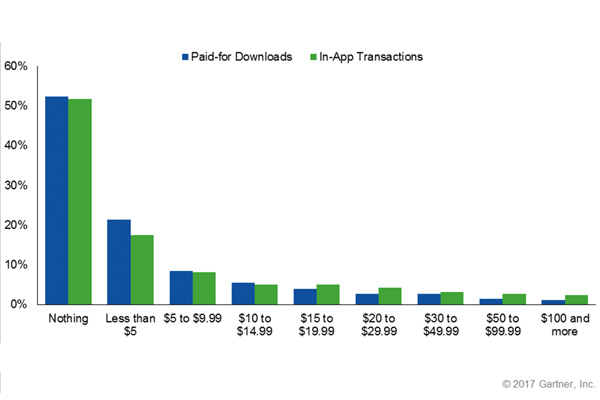

According to a Gartner survey, in-app transactions are up 26% from 2015 while paid-for downloads only increased 4%. While the majority of users still want to spend nothing on apps, those that do spend are more apt to spend via in-app transactions.

Thus it still makes the best business sense of keep apps cheap and rely on incremental spend within the app. And don’t worry about these “microtransactions” turning users off. Even with fickle gamers, 77% felt microtransactions can be beneficial overall. As long as you’re not nickle-and-diming your users, and your app is designed to deliver genuinely better features from in-app transactions, this can be your best bet to generating revenue from your mobile app.

In all, things are looking very rosy on the mobile revenue front. How is your company taking advantage of this trend?